The trouble with paying remote workers and freelancers spread across the world is not new.

However, this has become more apparent as remote work, freelancing, and the future of work progresses.

One way to pay remote workers is through bank transfers, which are slow and often incur hefty fees.

Another option is PayPal, but this still incurs high transaction fees (and your remote employee or freelancer may be located in a country that PayPal has blacklisted).

As a result, many companies and startups are using Wise (previously TransferWise) to pay freelancers and remote employees. It’s faster than banks and PayPal and has some of the best exchange rates for users.

In this piece, let’s find out more about Wise and how it can be your payment backbone as a remote team.

What is Wise?

Wise was launched with the promise to simplify and disrupt the international money transfer industry.

So far, Wise has saved their customers billions and counting in money transfer fees, exchange rates, and more.

With a Wise account, you can send money in local currency with just a few clicks. And then it will handle the conversion for you and deliver your cash to your recipient’s bank account in their own local currency.

Some interesting stats about Wise (TransferWise)

- Wise was launched in 2011

- The company boasts 12+ million users

- Users of Wise send and receive over $8 billion each month and save over $4 million.

- From your Wise multi-currency account, hold and use 54 different foreign currencies for both personal and professional purposes.

- You can send money to more than 80 countries with Wise

- Hold and use 54 different foreign currencies for both personal and professional purposes

- Wise offers an international debit card for individuals, which can be used for withdrawals and purchases.

- Debit cards provided by Wise are compatible with Apple Pay and Google Pay.

- Access to your own US routing number, UK account number, euro IBAN, and more,

- Receive payments in ten different currencies just like a native.

Key features of Wise for remote teams and freelancers

Transferwise is a cross-border money transfer company that provides a variety of features for freelancers, remote workers, and digital nomads. These features include:

- Personal, international bank account

- Pay your remote employees and freelancers

- Global account to receive freelance payments or take your remote work salary

- Convert and hold multiple currencies

- Move money between countries (remote employers)

- Link your account to Amazon, PayPal, and more (for online retailers)

Your personal, international bank account

With Wise, freelancers, remote workers, and digital nomads can create and own their international bank accounts and operate like a global workforce.

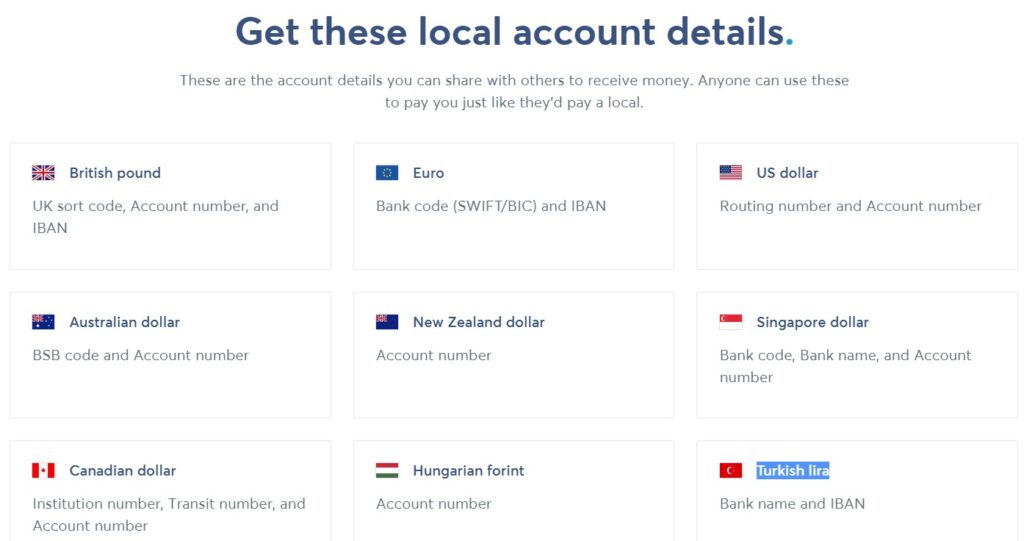

The bank details you can create with Wise include: GBP, USD, AUD, EUR, CAD, SGD, and TL.

You’ll also receive all the details of the accounts you decide to operate so that anyone, anywhere, can pay you.

A global account to receive freelance payments or take your salary as a remote worker

With a global account, you can receive payments in 9 international currencies and have your money instantly (3 working days in some cases) deposited in your account.

The global account is a convenient way to manage and receive funds from all over the world as a remote worker or freelancer.

Convert and hold multiple currencies

With Wise, you can hold and convert up to 53 currencies. Holding various currencies is totally free, and the platform would convert using the current real exchange rate.

Receive your salary, pension, and more.

Wise’s secure, robust app connects you to your new employers, pension providers, freelance clients, and more.

Move your money between countries.

With Wise, It’s simpler than ever to pay your bills and subscriptions in several currencies with Direct Debits in the UK, Europe, the US, and Canada. You can also send money to over 80 countries, at a cheaper and faster rate.

Link your account to Amazon, PayPal, and more

Wise is the ultimate tool for online sellers and affiliate marketers to reliably track, manage, and automate their work. Wise can automatically import your data from various platforms such as Amazon, PayPal, Shopify and more. Wise’s invoicing tool lets you invoice customers and keep up with your income from your various online platforms.

Why choose Wise as a remote employee, remote employer or freelancer?

Transferwise is an excellent choice for people who want to transfer their money internationally because of its low-cost, transparent and secure services.

A great range of services excellent for remote employees, freelancers, and digital nomads

Wise Money Transfer provides a wide range of services for their customers. They offer currency conversion, international payments, and global remittance services. As a remote employee or freelancer, this is an excellent platform to get paid and manage your finances.

Global regulation for trusted money transfer for freelancers

Wise regulated by authorities around the world. This includes the FCA in the UK and FinCEN in the United States.

Great anti-fraud team to protect your remote workforce

Wise takes fraud seriously, and is always on the lookout for new ways to safeguard you. They do this through their dedicated anti-fraud team to ensure that money moves safely from one person to another without issues.

Cheaper transfer and conversion fees for remote teams

TransferWise charges a small fee for each transaction, but it’s cheaper than the fees charged by banks or traditional money transfer services like Western Union or MoneyGram International.

Lots of withdrawal options

The company offers a number of withdrawal options for users with accounts and they are all very easy to use. This includes bank transfers, credit cards, and through mobile wallets, especially in parts of Africa where they’re present.

Many payment partners

Transferwise’s global network of local banking partners can provide faster transfers than those offered by the banks directly to customers

Get your Wise (TransferWise) account through my link and get a fee-free transfer of up to 500 GBP.

Create a Free Wise Account NOW

- Workcation Wonderland: The Best Places to Work Remotely and Travel during the Holidays - September 20, 2023

- 50 Zoom Trivia Questions And Answers To Excite Your Remote or Hybrid Team - September 13, 2023

- Lano.io Review: Simplifying Global Employment and Payroll in 170+ Countries - September 13, 2023